Hey everyone thanks for listening to the video my name is Bob Babinski and I see it's, and we work with taxpayers with tax issues including tax preparation and planning for both businesses and individuals, and we help taxpayers our specialty is helping taxpayers who have IRS problems we're located in Richardson Texas which is right outside of Dallas Fort Worth, but we help taxpayers throughout the nation with IRS issues this is the third in a series of videos that's on cancelled debt forgiveness, and today we're going to cover the insolvency exclusion so just an overview of everything. If you had a loan if somebody lent you money or business lent you money such as a bank or a mortgage company and that debt was forgiven it becomes income to you the borrower for the full amount the lender is typically going to send you a form 1099 C, and you're going to report it on your form 1040 under other income. There are some situations where that doesn't have that's not completely true one of them is an excludable amount from taxable gross income in that case you're gonna actually report it on your tax return, and then you're going to get an exclusion that's going to be calculated on Form 982 and then there are exceptions that we covered last week in which it is just not considered to be income. There's something about the type of item, and we went over some of the more educational type loans were special circumstances occur with it and so on. You know maybe it was turned into a gift or a part of an inheritance or so on, so there are certain exceptions today we're going to cover. We are going to cover the insolvency exclusion one way...

PDF editing your way

Complete or edit your Insolvency Worksheet Form anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export Insolvency Worksheet Form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your Insolvency Worksheet Form as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your Insolvency Worksheet Form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Insolvency Worksheet Form

About Insolvency Worksheet Form

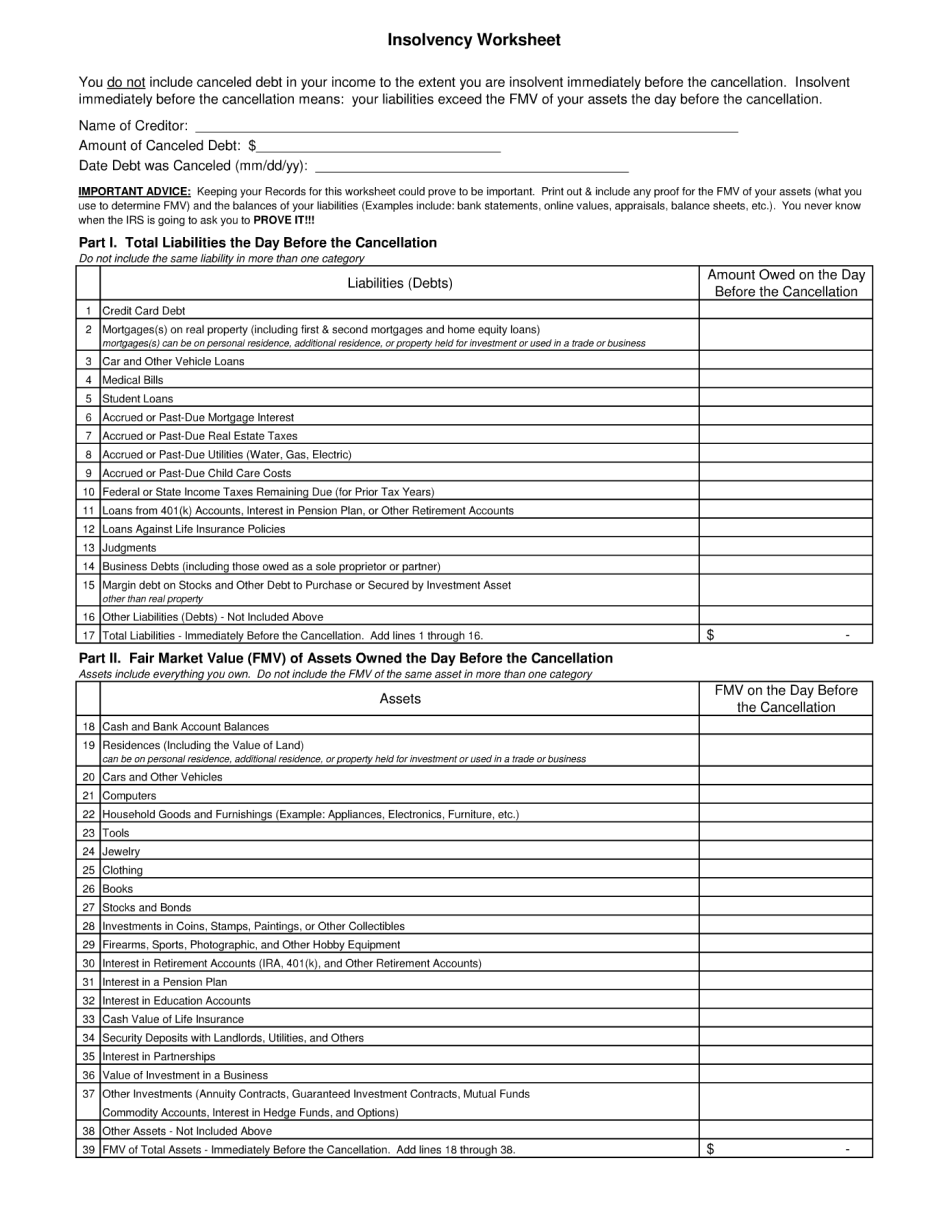

The Insolvency Worksheet Form is a document used to determine if a taxpayer is insolvent at the time a debt is cancelled or forgiven. When a taxpayer is insolvent, their liabilities exceed the fair market value of their assets. This form helps calculate the amount of debt that can be excluded from taxable income under certain conditions. The insolvency worksheet form is required by individuals who have had their debts cancelled or forgiven and want to determine if they qualify for the insolvency exemption. This exemption applies to cancelled debt that exceeds the taxpayer's total assets, liabilities, and net worth. A taxpayer must complete this form to show the IRS that they were insolvent at the time the debt was forgiven or cancelled. The form is filed with the taxpayer's tax return for the year the debt was cancelled or forgiven.

Online alternatives allow you to coordinate your own document operations and raise the productivity of one's workflow. Continue with the speedy information to carry out Insolvency Worksheet Form, stay away from problems along with furnish that on time:

How to finish a Insolvency Worksheet Form on the web:

- On the web site with the form, simply click Start Now and move for the writer.

- Use the particular indications for you to submit established track record areas.

- Type in your own details and phone info.

- Make sure one enters right information and also figures inside suitable fields.

- Carefully check the written content of the file as well as grammar and punctuation.

- Go to Help part if you have inquiries or even deal with our own Help team.

- Place an electronic trademark on your Insolvency Worksheet Form by making use of Signal Instrument.

- When the shape is done, press Accomplished.

- Send out the particular all set document by means of e-mail or send, art print it as well as safe money on your own gadget.

PDF rewriter permits you to create alterations in your Insolvency Worksheet Form from any World Wide Web linked device, personalize it in accordance with the needs you have, indication this in electronic format as well as deliver in another way.

What people say about us

Do we still need all this paper?

Video instructions and help with filling out and completing Insolvency Worksheet Form